Why a family’s financial future is now at stake

A security camera shows one of the thieves crawling on his stomach through the neighboring store to avoid motion sensors and then spray-painting the camera lens.

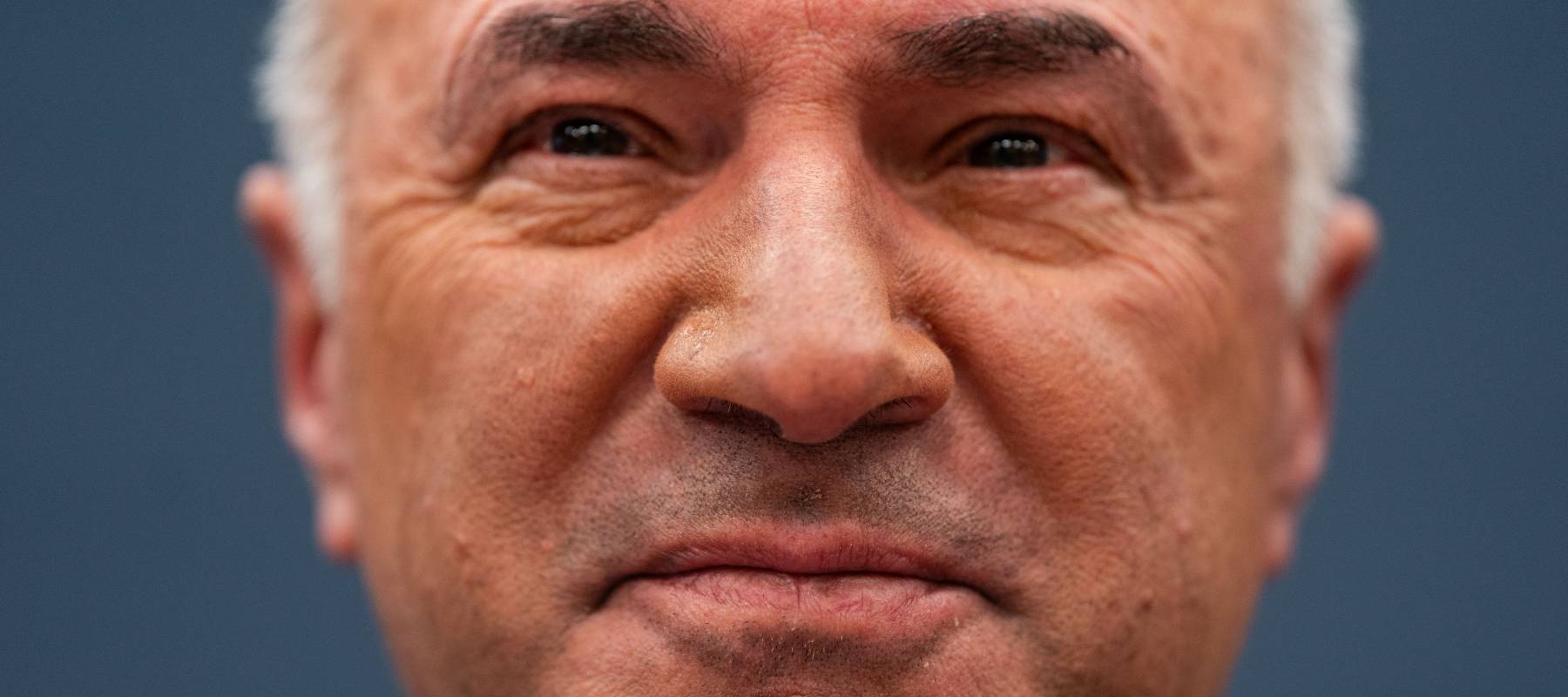

“This wasn’t random,” Ted Mackrel, owner of Dr. Conkey’s Candy and Coffee told KABC. “They sawed a hole in our roof Sunday evening of Memorial Day weekend and managed to dodge all security systems.”

From there, the thieves dropped into the shop’s bathroom, shimmied along the floor and spent at least three hours cutting through a concrete wall and then a heavy safe.

Mackrel says the break-in was discovered on Monday morning when staff reported “a big hole in the wall leading to the jewelry store.”

According to Jacob and Jonathan, the thieves stole all of the gold and jewelry in the safe, as well as customers’ heirloom pieces — including a Rolex watch — that they were repairing at the time of the break-in.

But that wasn’t all they lost.

“It’s a hit,” Jonathan, who now runs the family business, told KTLA5. “It’s [my dad’s] retirement, my future. I have a young family and three daughters. It’s a lot to have to rebuild from, especially because my dad is 71. He can’t work forever.”

Since the incident, the local community has started a fundraiser to help the family get back on their feet.

Invest in real estate without the headache of being a landlord

Imagine owning a portfolio of thousands of well-managed single family rentals or a collection of cutting-edge industrial warehouses. You can now gain access to a $1B portfolio of income-producing real estate assets designed to deliver long-term growth from the comforts of your couch.

The best part? You don’t have to be a millionaire and can start investing in minutes.

Learn MoreA risky strategy for retirement

This event reveals a critical vulnerability that many small business owners face: relying entirely on their business as their retirement plan.

Recent Gallup research found that most small business owners don’t have a succession plan, yet 74% of employer-business owners have plans to sell or transfer the ownership of their business for retirement.

An earlier 2025 survey by SCORE found that 34% of entrepreneurs have no retirement savings plan for themselves, with 18% planning to sell their business and use the money to fund their retirement. Another 21% have already used their retirement savings to invest in their business.

But this strategy comes with risks, including a lack of diversification, liquidity challenges and even the myth of the eventual sale.

“Of the approximately 77 million baby boomers in the U.S., an estimated 12 million have ownership in privately held businesses,” according to a whitepaper by Butcher Joseph & Co. and ITR Economics.

At the same time, about 10,000 baby boomers reach retirement age every day. But many are facing a similar problem, since “their would-be heirs would rather have the proceeds of a sale than take over the family business.”

Another problem, however, is that with an influx of baby boomers looking to sell, “we’re entering an environment where buyers have the upper hand,” according to Entrepreneur.

That may be good news for young entrepreneurs looking to buy an established business, but perhaps less so for small business owners dependent on the sale for their retirement.

How to save for retirement

If you’re self-employed or run a business, you may want to avoid putting all your retirement eggs in one basket.

If you’re self-employed and don’t have any employees, consider a solo 401(k) to beef up your own retirement savings. If you have employees, a Simplified Employee Pension (SEP) IRA can help both owners and their employees contribute toward their retirement.

You may also want to consider contributing to personal investment accounts separate from the business. The more diversified you are, the better.

And don’t forget about liquidity. If you can’t sell the business right away, what would that mean for your retirement goals?

It’s well worth consulting with a financial advisor as well as experts in succession planning to make sure you have an exit strategy that leaves you with options.

The richest 1% use an advisor. Do you?

Wealthy people know that having money is not the same as being good with money. WiserAdvisor can help you shape your financial future and connect with expert guidance. A trusted advisor helps you make smart choices about investments, retirement savings, and tax planning.