55M+

Readers

300+

Reviews

3,000+

Metrics

Partners on this page may provide us earnings.

55M+

Readers

300+

Reviews

3,000+

Metrics

Partners on this page may provide us earnings.

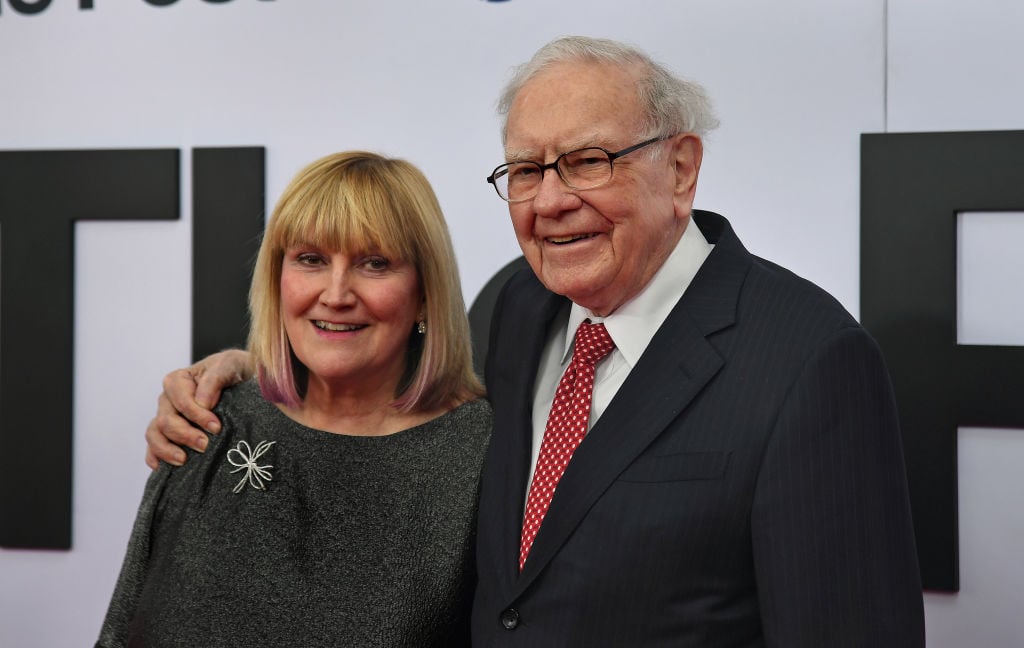

Based on the latest available 2025 data, Warren Buffett’s net worth is estimated to be $161 billion.1

Warren Buffett is one of the world’s most famous investors. According to Bloomberg and Forbes, Buffett has a net worth of $161 billion, making him among the top five wealthiest people on the planet.2

Most of Buffett’s fortune is tied to Berkshire Hathaway, his publicly traded investment vehicle. Buffett owns about 15% of Berkshire. His net worth is closely linked to the holding company’s share price movements, and his big stake nets him substantial dividend income.3

Berkshire, whose holdings include Geico, Dairy Queen, Coca-Cola, Apple, and American Express, has delivered a compound annual gain in market value of about 19.8% since 1965. It is one of the biggest and most popular stocks in the world, thanks mainly to Buffett’s high-profile reputation as the greatest buy-and-hold investor of his generation.4

Buffett shocked investors worldwide when he announced on Saturday May 3rd, 2025 that he would retire from Berkshire Hathaway by the end of the year. By Monday, Berkshire Hathaway stock dropped 7% as investors reacted to the news.5, 6

Various factors contributed to Buffett’s financial success: having an entrepreneurial spirit, good role models, access to start-up capital, solid investing principles, discipline and patience and a bit of luck.

Buffett has always been good with money. He’s known for being frugal and was setting up profitable businesses from a very young age, including selling chewing gum and delivering newspapers. By high school, he’d already bought a pinball machine business.7

In his early 20s, Buffett formed Buffett Partnership Ltd., using funds from friends and family. By applying Benjamin Graham’s value investing philosophy (buying undervalued companies with strong fundamentals) he grew the fund’s assets quickly. Over the course of the 1950s, he ran several successful partnerships that consistently beat market returns.8

By the early 1960s, with millions under management, Buffett began consolidating his partnerships and seeking a more scalable investment vehicle. He identified Berkshire Hathaway, then a struggling textile firm, as an opportunity. Though initially a value play, Buffett eventually pivoted, using Berkshire as a holding company to buy stakes in strong, cash-generating businesses like Coca-Cola, American Express and The Washington Post.9

Buffett’s reputation for identifying undervalued companies and holding them long-term earned him widespread acclaim. Over time, he became one of the most respected investors in the world — and Berkshire’s share price, along with Buffett’s wealth, continued to rise.

Berkshire Hathaway Inc. is a multinational conglomerate holding company headquartered in Omaha, Nebraska. Founded and led for decades by Warren Buffett, the company is known for its diverse portfolio of wholly owned businesses—ranging from insurance (GEICO), energy (Berkshire Hathaway Energy), and transportation (BNSF Railway) to retail and manufacturing. It also holds significant minority stakes in major publicly traded companies, including Apple, Coca-Cola, and American Express. Berkshire Hathaway stock is available in two classes: Class A (BRK.A), which is among the highest-priced stocks in the world, and Class B (BRK.B), which offers more accessible entry to investors with similar economic exposure but fewer voting rights.

Warren Buffett’s investment portfolio is closely tracked by investors and analysts alike, largely because Berkshire Hathaway is required by law to disclose its holdings. As a publicly traded company, Berkshire must file a 13F report with the U.S. Securities and Exchange Commission (SEC) each quarter. This filing details all equity holdings, offering a transparent view into the stocks Buffett and his team are buying, holding, or selling.

Berkshire’s 10 biggest holdings at the end of 2024, according to its 13F filing on February 14, 2025, are:10

Berkshire’s portfolio is both diversified and heavily invested in a small handful of stocks.

The biggest holding by quite some margin is Apple. The iPhone maker has been a key investment of Buffett’s since 2016. Buffett initially avoided tech stocks but made an exception for Apple due to its strong brand loyalty, product innovation and business model.

In 2024, he sold a big portion of his lucrative stake, reportedly due to potential future tax increases, an overstretched valuation, and the fact that Apple’s growth had eroded the portfolio’s diversification. However, it still remains a significant holding.

Your net worth is a snapshot of your financial health — and a net worth tracker helps you monitor it in real time. Whether you're tackling debt or planning for retirement, tracking your progress shows you exactly where you are and where you're headed.

Empower offers one of the best free net worth trackers through its Personal Capital dashboard, acquired in 2020. It lets you easily monitor your assets and liabilities in one place, helping you budget, invest, and plan for retirement — all at no cost.

Buffett not only owns a big slice of Berkshire. He’s also the company’s CEO and chairman. Insiders say Buffett spends roughly eight hours a day in the office. And his base salary is $100,000, which is the same it’s been for the last 40-odd years.12

Buffett is largely responsible for earning much less than his peers. He’s the one who recommends his pay to the company’s board of directors.

Opting for a modest salary with no bonus or stock awards reflects Buffett’s relatively modest lifestyle. He lives in the same house he bought for $31,500 in 1958, drives an old car, and is said to eat breakfast at McDonald’s.13

It’s also worth pointing out that Buffett’s base salary isn’t the only money he has to live off. His full compensation is significantly higher. Buffett claims expenses from Berkshire, which often surpass his annual wage, and rakes in quite a bit from his personal investment portfolio.14

Warren Buffett’s long career is filled with important moments that helped solidify his reputation and build his wealth. Below we list his key milestones and the years they occurred.

Buffett's decisions are guided by a set of principles that he’s stuck to for decades.

One of Buffett’s key philosophies, passed on from his mentor Benjamin Graham, is to buy companies with strong fundamentals when they are out of favor with investors and undervalued.15

Strong fundamentals generally means having a robust competitive advantage, good management team, and generating lots of cash. Of equal importance to Buffett is that he invests in businesses that are clear about what they do.

Patience is another key virtue. Buffett is known for buying and then holding for a very long time. Once he invests in a company, he tends to stand by it, provided it continues to meet his criteria. "Our favorite holding period is forever,” Buffett wrote in a 1988 letter to shareholders.16

Warren Buffett was born August 30, 1930, in Omaha, Nebraska. His father, Howard, was a stockbroker and congressman, and his mother, Leila, was a homemaker. Growing up in Omaha contributed to Warren’s down-to-earth personality, while having a stockbroker dad piqued his interest in investing.

Buffett received a Bachelor’s degree in Business Administration in 1950, then studied economics under Benjamin Graham at Columbia Business School in New York. Meeting Graham was a big moment in Buffett’s life and profoundly influenced his investment philosophy.

Buffett’s personal life is fairly low-key. He’s known for spending little and not being interested in a lavish lifestyle. He’s also viewed as a family man. Buffett had three children with his high school sweetheart and they remained married until she passed away in 2004, despite living apart since the 1970s.

Buffett is generally regarded as a good investor and nice guy. However, his clean cut image has come under fire at times. Buffett has been accused of engaging in unethical business practices on several occasions, including replicating Berkshire trades in his personal account before they were disclosed to the public.

Daniel Liberto is a financial journalist with over 10 years of experience covering markets, investing, and the economy. He writes for global publications and specializes in making complex financial topics clear and accessible to all readers.

The content provided on Moneywise is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.