Preparing financially for a new baby

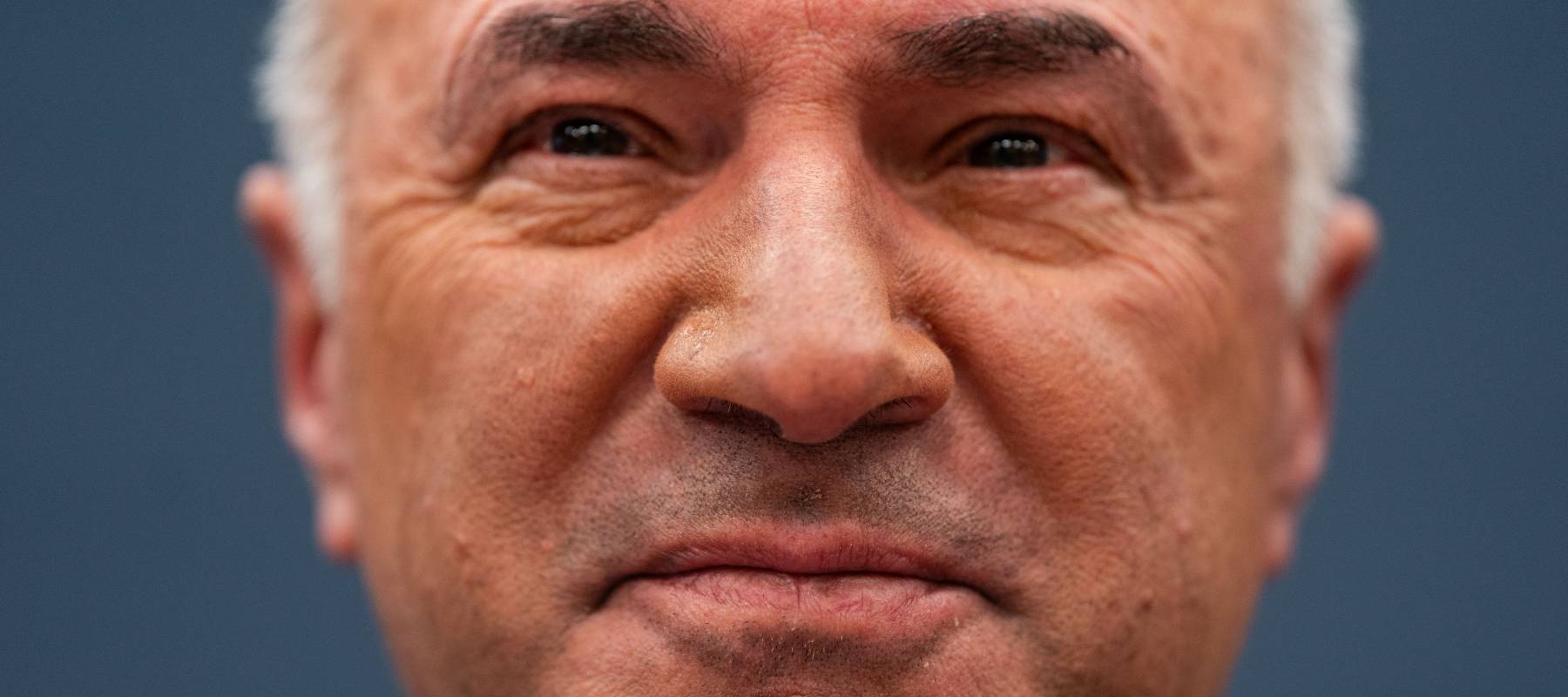

After taxes, Johi makes about $4,500 a month, though a few months ago she started taking on side hustles so she now brings in about $5,500 a month. She’s not sure that’s sustainable as her pregnancy progresses.

Normally Ramsey recommends paying off debts first. But with a baby on the way, he says to “stop your debt snowball and pile up cash” for a baby budget.

“I want you to get the biggest possible pile of cash you can get between now and baby,” he told Johi. “Treat it like you’re paying off debt,”

With her side hustle, she could save about $3,000 a month for over five months. She may need to slow down her side hustle as she nears her delivery date, but could save $15,000.

Fortunately, Johi has health insurance, though she’ll need to contact her provider to find out what her out-of-pocket costs will be for obstetric appointments, labor and delivery.

Generally for someone with health insurance, those add up to $2,854 — including your health insurance deductible, copayments and coinsurance — according to the Peterson-KFF Health System Tracker..

If Johi didn’t have health insurance, she’d be looking at $18,865 in out-of-pocket costs.

Low-income single moms without health insurance can apply for Medicaid or CHIP (Children’s Health Insurance Program) to see if they’re eligible for free or low-cost health coverage. They may also qualify for certain subsidies or tax credits.

Invest in real estate without the headache of being a landlord

Imagine owning a portfolio of thousands of well-managed single family rentals or a collection of cutting-edge industrial warehouses. You can now gain access to a $1B portfolio of income-producing real estate assets designed to deliver long-term growth from the comforts of your couch.

The best part? You don’t have to be a millionaire and can start investing in minutes.

Learn MoreWhat to do once baby has arrived

If Johi does as Dave Ramsey advises, she could have up to $20,000 saved when she comes home with her new baby. That gives her options.

Ramsey told her that if she doesn’t have other expenses, she could write a check for $14,000 and pay off her car.

“You don’t really lose any ground on your get-out-of-debt plan,” he said.

From there, she can restart her financial goals. Ramsey’s baby steps include building out an emergency fund, paying off all debt (except your mortgage) using the debt snowball method and investing 15% of your household income for retirement, among other things.

Johi should also consider contacting her state's child support agency, which is responsible for child support enforcement. USA.gov offers resources to help.

Child support could help Johi supplement her income if she’s unable to continue her side hustle in the latter part of her pregnancy or after she gives birth. And it holds her deadbeat partner accountable, Ramsey added.

“Most states have a law that if you make a baby, you get to help pay for it,” he said.

The level of child support depends on where you live, according to Custody X Change. The national average is $721 a month but can range from $402 to $1,187 a month.

Judges can adjust the levels based on evidence, and sometimes parents agree on the amount of child support a partner will pay.

The richest 1% use an advisor. Do you?

Wealthy people know that having money is not the same as being good with money. WiserAdvisor can help you shape your financial future and connect with expert guidance. A trusted advisor helps you make smart choices about investments, retirement savings, and tax planning.