How phone porting scams work

Phone porting is a legitimate process that lets you keep your phone number when switching carriers, and it’s typically protected by verification safeguards. But scammers have learned how to exploit it.

“To work around these protections, scammers will gather personal information about their target online, combing through social media posts, or purchasing information from cyber thieves or hackers,” according to the Federal Communications Commission (FCC).

If fraudsters have the right combination of personal information — which could include your address, birth date, Social Security number, PINs and passwords — they “may be able to con the victim’s phone company into believing the request to port out the number is from the authorized account holder,” says the FCC.

Once the fraudster convinces your phone company to transfer your number, your phone goes offline — and theirs lights up with your messages and calls, often allowing them to bypass safety measures like two-factor authentication.

“Once the scammer has access, they attempt to drain the victim’s bank accounts,” says the FCC. “In another variation, the scammers may attempt to sell or ransom back to the victim access to their social media accounts.”

This happened to Associated Press reporter Fatima Hussein in 2024, who woke up one morning to discover she didn’t have cell service. “Using my home Wi-Fi connection, I checked my email and discovered a notification that $20,000 was being transferred from my credit card to an unfamiliar Discover Bank account,” she explained in an article for the Financial Post.

Hussein said it took 10 days to get her number back from Cricket Wireless. “And that wasn’t until I told company representatives that I was writing a story about my experience,” she wrote in the Financial Post. During that time, fraudsters had accessed her account three times and transferred $19,000 from her credit card to the same unfamiliar account, even after freezing her credit and changing all her passwords. Bank of America was working to reverse the $19,000 transfer.

Neither McLean nor Hussein know how fraudsters got their information.

Dave Ramsey’s plan has people crushing debt fast

Drowning in debt? Dave Ramsey’s viral 7-step method is helping people wipe it out and finally build real savings. No gimmicks—just a clear plan that works. Moneywise breaks it down so you can get started in minutes. If you’re serious about getting ahead, don’t miss this.

See the stepsHow to protect yourself from phone porting scams

In 2024 alone, SIM swapping scams led to nearly $26 million in reported losses, according to the FBI — and the real figure may be even higher, since many victims don’t report.

- To minimize the risk, start by asking your wireless provider about port-out authorization. “Every major wireless has some sort of additional security for accounts or for port-out authorization that customers can set up, like a unique pin, or add verification questions, which will make it more difficult for someone to port out your phone,” according to the Better Business Bureau (BBB).

- Be on the lookout for phishing scams, which can lead to phone porting scams. A phishing scam takes place when fraudsters try to trick you into giving away personal information, typically by posing as a legitimate individual or business (such as an HR manager or your bank). They may contact you via text, email or phone.

- Never give away any personal information to a call or email from an unknown contact. Hang up (or ignore the email) and contact the individual or business with a trusted phone number or even an in-person visit.

“Typically, loss of service on your device — your phone going dark or only allowing 911 calls — is the first sign this has happened,” according to the FCC.

If this has happened to you, time is of the essence. Contact your phone company and bank, and place a fraud alert on your credit reports. Aside from filing a police report, you can also file a complaint with the FCC.

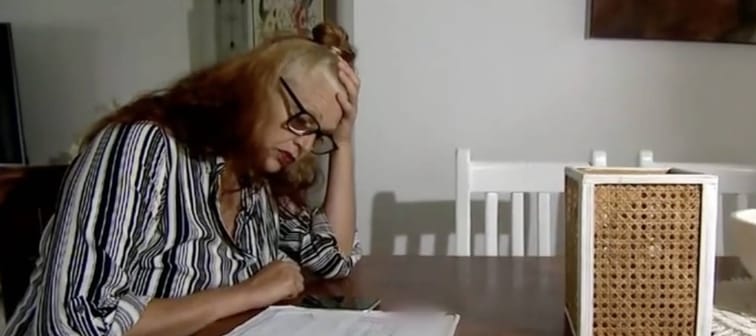

But for victims like McLean or Hussein, recovery can be a long, difficult process.

“My days are basically taken up by trying to prove who I am again,” McLean told 9News, “and piece by piece trying to put my life back together.”*

Under 60? Lock in life insurance in minutes

Get term life insurance fast—with no agents, no exams, and no stress. Ethos lets you apply online in minutes and get covered for as low as $15/month. It’s affordable peace of mind, without the hassle Get your free quote now